How do you go from dreaming of owning a home to holding your first set of keys? If you’re like most first-time buyers, the down payment is your biggest hurdle. But, it could pay off big time to know your down payment options.

There are more than 2,400 home buyer programs available across the country–they can be as unique as the home buyers and communities they serve. Let’s break down the basics of today’s home buyer programs.

What are home ownership programs?

Programs can include loans, grants, tax credits and other programs for eligible home buyers that can help them achieve the down payment faster, cover closing costs and get into a home sooner than they would have otherwise.

Who offers these programs?

- State Housing Finance Agencies (HFA) often offer the broadest array of opportunities.

- Cities and Counties offer programs with criteria adjusted for local median income and home prices.

- Housing Authorities

- Non-profits

- Employers

How do you qualify?

Both you and the home you are purchasing must be eligible. Home ownership programs are for owner-occupant buyers only, no investment properties. You must make a minimum investment, qualify for a first mortgage and complete home buyer education. Common eligibility factors include the home’s sales price, home buyer income and home ownership history.

And, your occupation can help give you a boost. There are often additional benefits, or even entirely separate programs, for educators, protectors, health care workers, veterans and households with disabled members.

Do you have to be a first-time home buyer?

First, it’s important to know that a first-time home buyer is defined as someone who hasn’t owned a home in 3 years. So, if you’ve owned in the past, but are renting now, you may be a first-timer again! Plus, across our databank of programs, 37 percent don’t have a first-time home buyer requirement.

3 most common types of programs

Down Payment Programs

These programs are normally soft second or third mortgages or grants, providing benefits such as 0% interest rates, deferred payments and forgivable loans. The assistance amounts will range from a few to tens of thousands of dollars and can be used towards the down payment, closing costs, prepaids, principal reductions and/or repairs.

Don’t count out high cost markets. Program benefits and eligibility requirements are adjusted based on a percentage range of the area’s median income and home prices.

If you’re purchasing a home in a target area designated by the housing finance agency, you may receive special benefits such as higher assistance amounts, more lenient income requirements and if there’s a first-time home buyer requirement, it may be waived.

Affordable First Mortgages

Many larger housing finance agencies, particularly at the state level, offer first mortgages to accompany their down payment assistance programs. These first mortgages typically offer a below market interest rate, and may even have reduced closing costs, fees and no mortgage insurance requirements.

They are often funded by state housing finance agencies and may subsidize portions of the interest to offer effective rates below what the normal market can provide, helping lower your buying costs and monthly payments.

The USDA also has two first mortgage programs: the Rural Direct Loan and the Rural Guaranteed Loan. Both loans are primarily used to help low- and moderate-income individuals or households purchase homes in rural areas. Funds can be used to acquire, build (including purchase and prepare sites and provide water and sewage facilities), repair, renovate or relocate a home.

Mortgage Credit Certificates (MCC)

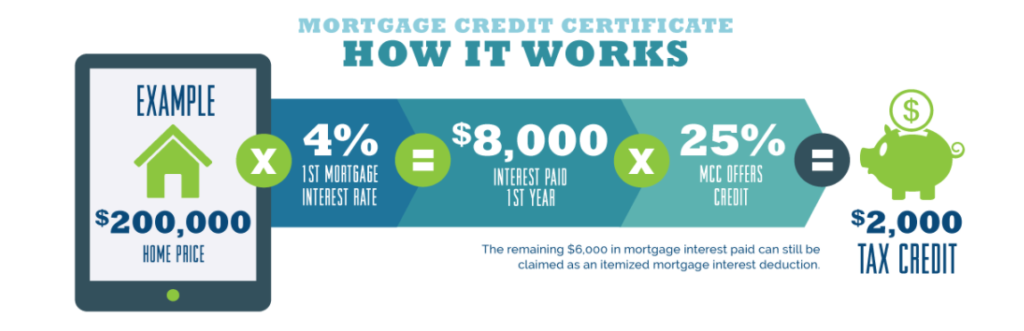

This annual federal income tax credit is designed to help first-time home buyers offset a portion of their mortgage interest on a new mortgage as a way to help qualify for a loan. As a tax credit, not a tax deduction, the MCC helps you reduce your annual taxes dollar for dollar. The mortgage credit allowed varies depending on the state or local government that issues the certificates, but is capped at a maximum of $2,000 per year by the IRS. MCCs can often be used alongside another down payment program.

As an example, if you were to receive an MCC that offers a 25% credit on a $200,000 loan for 30 years with a rate of 4%, the allowable tax credit would be figured as follows.

Plus, you can continue to receive a tax credit for as long as you live in the home and retain the original mortgage.

Search for programs in your area that may be a fit for your situation. You can also look up your state’s Housing Finance Agency and view available programs. View the agency’s list of participating mortgage lenders and interview a few to find the best fit for you.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach so talk to us to see if you can qualify for down payment assistance.

Selling a home

Here are some reports on systems that we use to help a homeowner get up to 18% more when they sell with us:

Get our Maximum Payoff Guide for Sellers as seen on Amazon.com FREE

or go to http://wesellhomesformore.com/ for more information on our selling process and why we sell for more.

Curious about what your home is worth goto http://www.socalhomevaluenow.com/ and find out instantly. This will give you a rough estimate on what your home is worth. For an accurate home value contact me directly for a free home value assessment.

Text Sell to 951-395-8057 and learn more about why you should sell your home with Team Olsewski.

Buying a home

If you are looking to buy a home whether its your 1st or 20th its important to choose the right agent. This decision could cost your thousands of dollars! Go to www.why-buy-with-us.com and see how we can help you!

Text Buy to 951-395-8057 and learn more about why you should buy your home with Team Olsewski.

Search for a home

Temecula | Murrieta | Menifee | Wildomar | Lake Elsinore | Corona | French Valley | Hemet | San Jacinto | Perris | Moreno Valley | Fallbrook